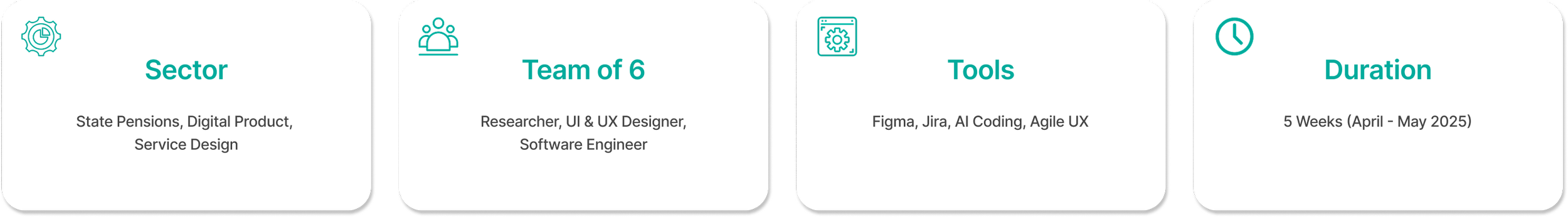

Project Overview

This project responded to an open brief from the Department for Work and Pensions (DWP), challenging us to identify service gaps and develop digital solutions that help people live easier and better.

My Achievements

Led end-to-end design process from discovery to alpha phase, ensuring alignment with Government Digital Service (GDS) standards and service design best practices

Analysed 500+ citizen responses by interpreting AI-generated qualitative data to uncover user patterns and pain points that automated analysis alone couldn't identify

Identified critical service gap in state pension planning, leading to the development of tools that enable citizens to forecast how life circumstances (working overseas, career breaks, part-time work) impact their pension outcomes

Facilitated sprint planning workshops to deliver a high-fidelity prototype within a compressed 5-week timeline

Maintained stakeholder alignment through weekly DWP collaboration sessions, incorporating feedback iteratively throughout the design process

Problem → Challenge → Solution

The Problem

Current DWP pension services offer static forecasts that fail to reflect individual circumstances and life changes. Citizens receive a single, generic projection, lacking insight into how factors like part-time work, living abroad, or claiming benefits impact their long-term pension outcome. This critical gap leaves users ill-equipped to effectively plan their finances and secure their retirement.

The Challenge

Understanding DWP Complex Ecosystem was time-consuming to understand. Additionally, without access to internal data, we gathered real user insights from public platforms like Facebook, Google, Reddit, and Trustpilot to identify recurring pain points.

Understanding the Diverse Users with vastly different circumstances added significant complexity to the design challenge.

Working with 5 weeks Tight Constraints to move from discovery to high-fidelity prototype, we needed efficient sprint planning while aligning with GOV.UK Design Principles, the Government Digital Service (GDS) framework, and WCAG accessibility standards.

The Outcome

The State Pension Planner successfully addresses a critical gap in existing DWP pension services. The solution was positively endorsed by DWP stakeholders, demonstrating its potential to significantly improve financial planning and retirement prospects for millions of citizens.

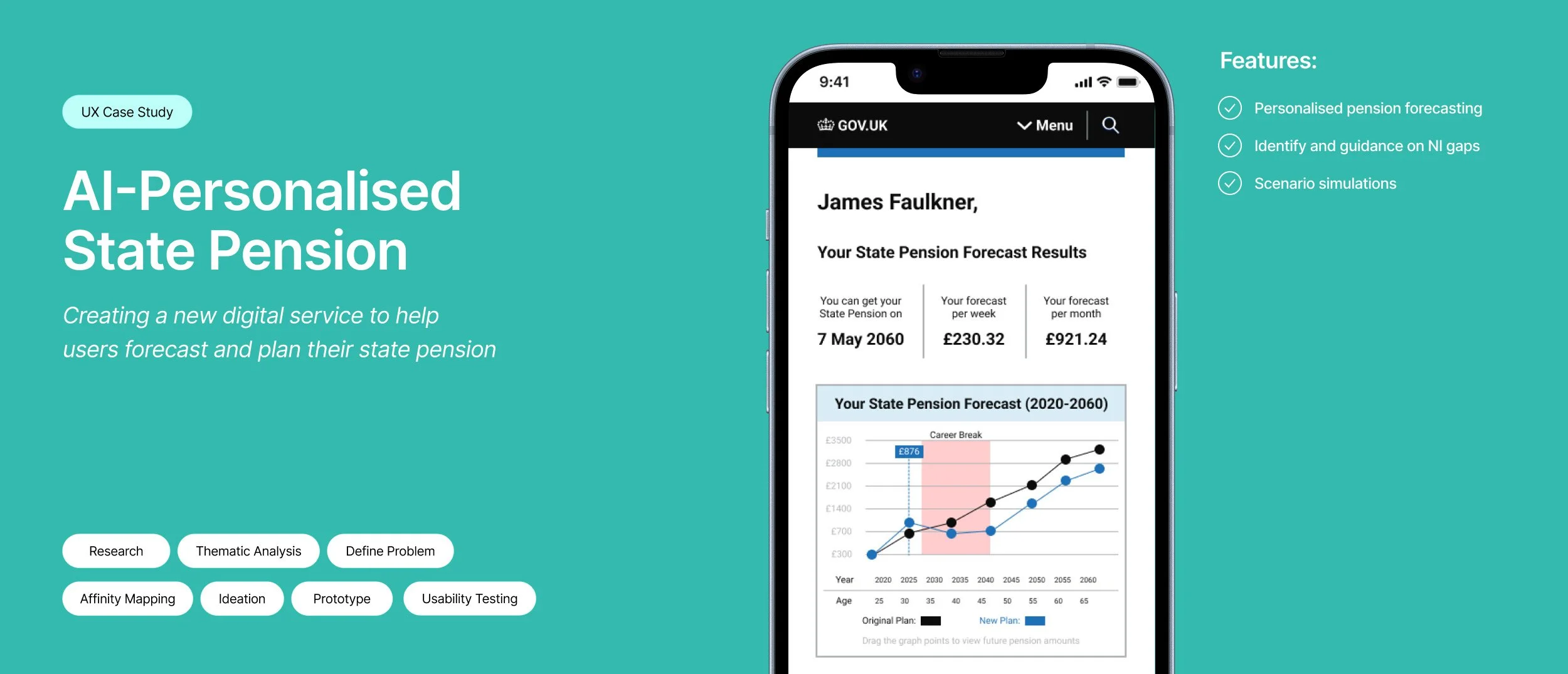

The Solution: State Pension Planner

We developed the State Pension Planner, a transformative digital product that empowers citizens to understand and optimize their pension journey. This solution moves beyond static projections, providing dynamic, personalised forecasts that adapt to each user's unique circumstances and real-life complexities.

Key features and impact:

Personalised Dashboard: A clear, at-a-glance overview displaying current pension status, National Insurance (NI) contribution history, and projected retirement income.

Dynamic Pension Calculator: An interactive tool that adjusts forecasts based on various life scenarios, allowing users to instantly see how relocation abroad, part-time work, or benefit claims impact their pension across different time periods.

NI Contribution Improvement Pathways: Proactive guidance on practical steps users can take to enhance their NI contributions

Accessible Support: Integrated contextual help, dynamic Q&A, and an AI-powered chatbot for instant assistance.

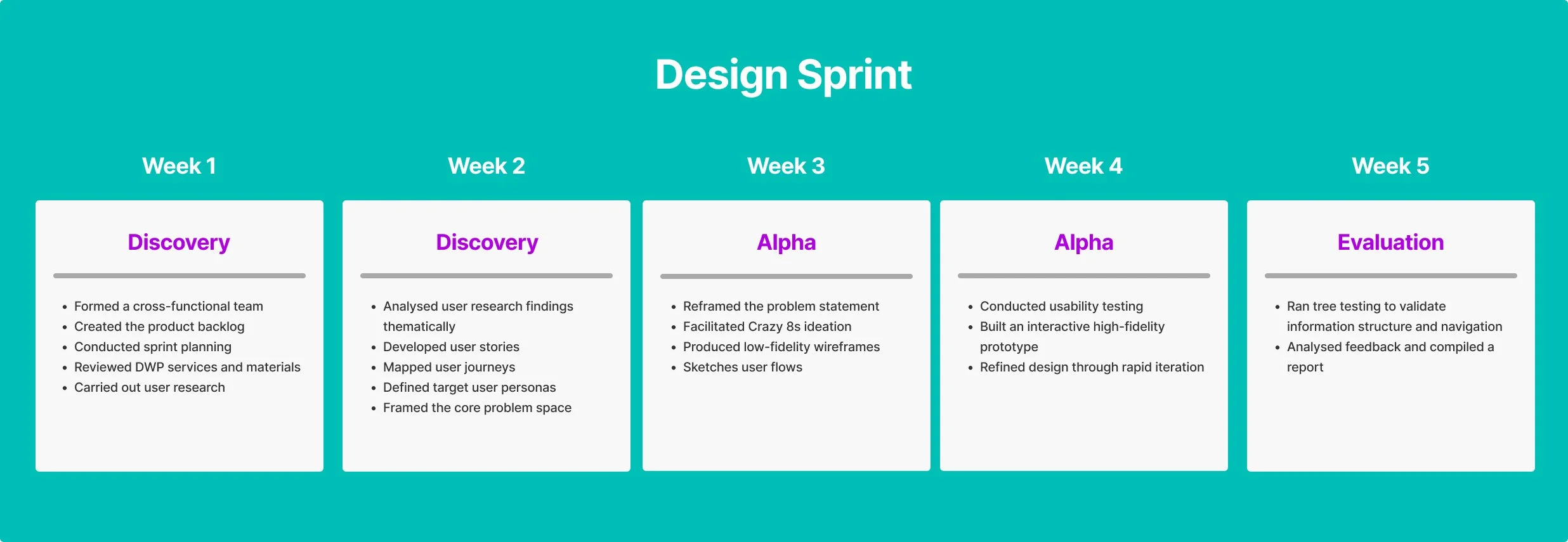

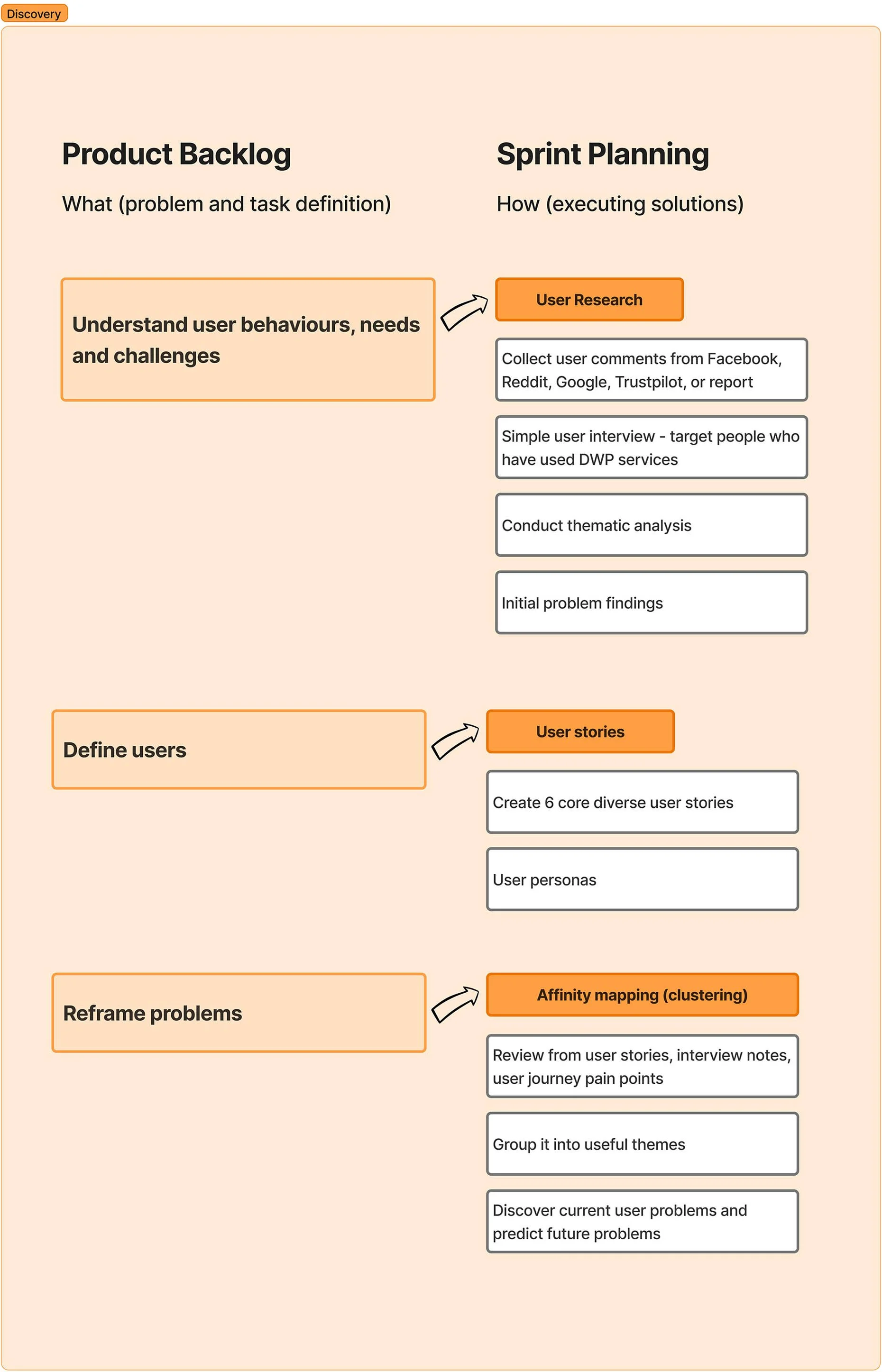

Discovery Stage

User Research

We explored how the DWP’s services work and analysed user feedback from public forums and social platforms. We also conducted informal interviews with people using DWP services to understand their behaviours and frustrations.

Key Focus

Through this research, I identified a core service gap: users lacked a way to clearly see their pension status or forecast future outcomes. Many were unaware of their current contributions or how life events could impact their retirement income.

Current unmet user needs - e.g., difficulty understanding NI contributions

Speculative future challenges - e.g., lack of clarity during life transitions

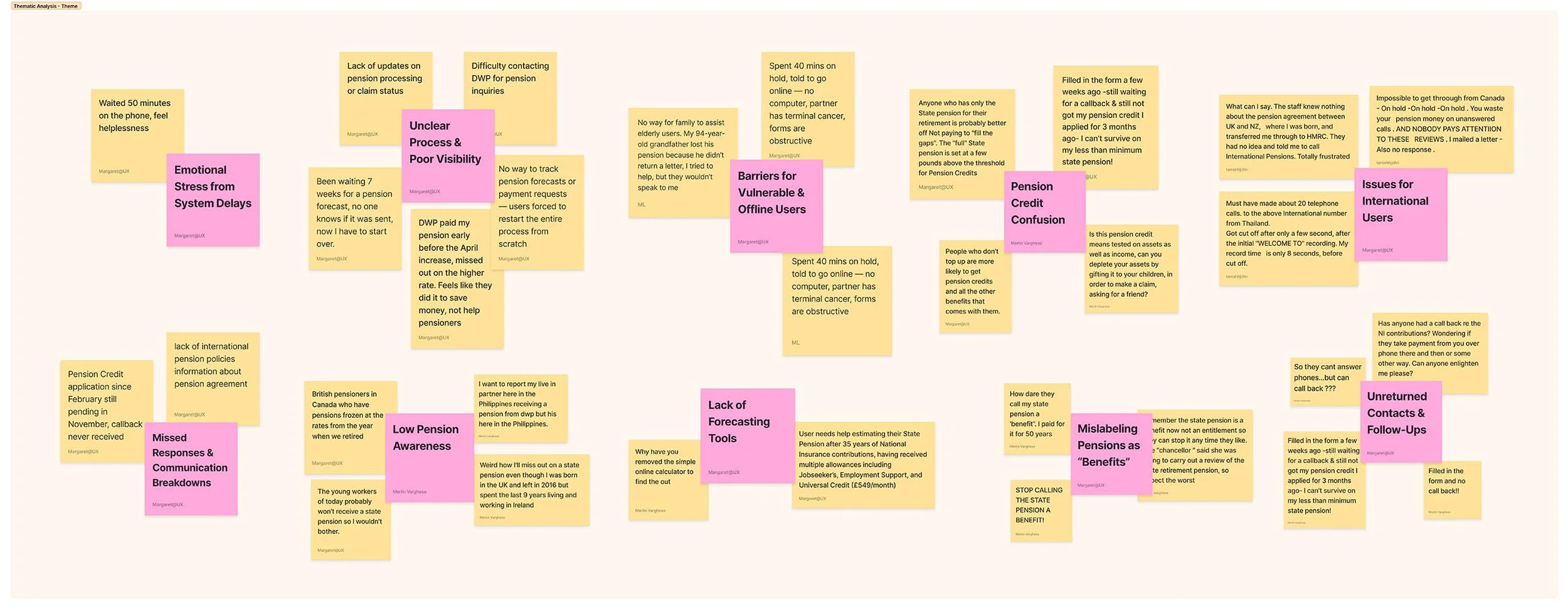

Thematic Analysis

Collected Data and Using AI-Assisted Coding

We initially used AI to scan public feedback for recurring patterns, but found it limited in understanding user emotion and context. Manual thematic analysis helped us uncover:

Uncertainty around NI contributions and eligibility

Frustration with missing or untracked contributions

Confusion about how life changes (e.g., career breaks, moving abroad) affect pensions

Limited support for low-digital-confidence users

Lack of personalisation or guidance in existing services

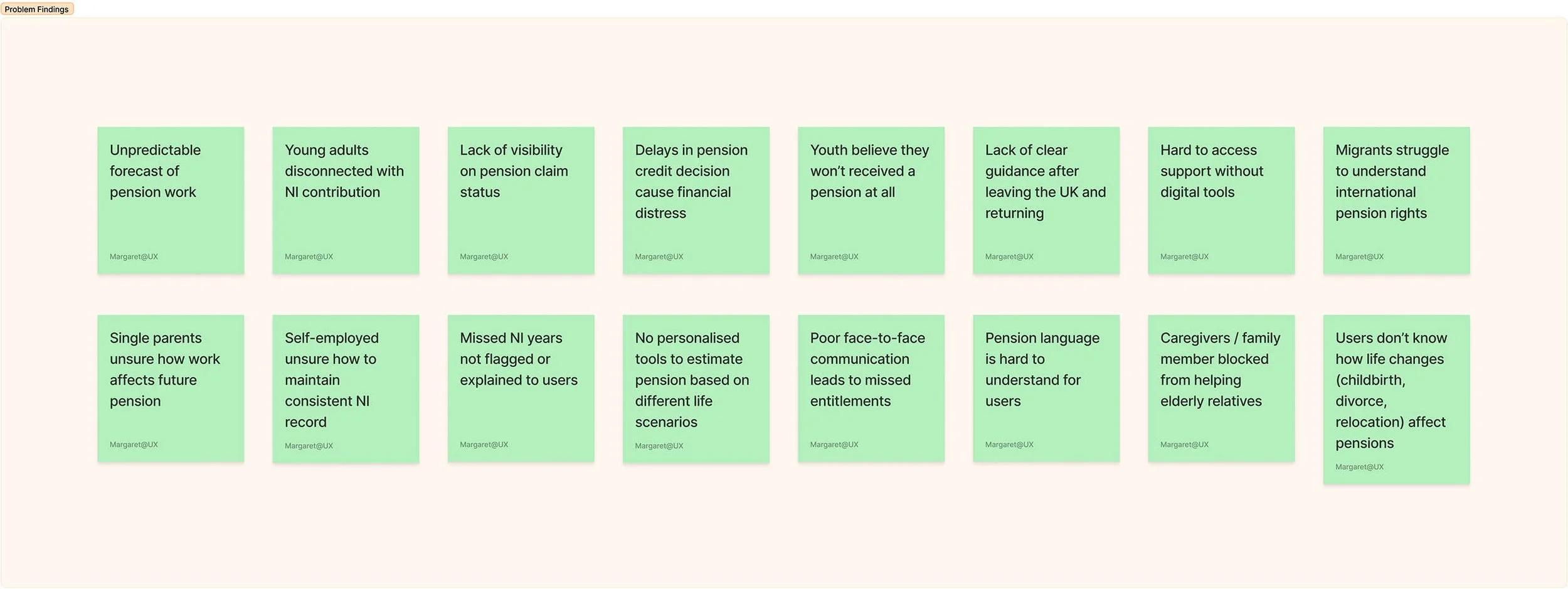

What We Found?

Through thematic analysis of user feedback, I uncovered a range of recurring challenges. These insights revealed significant gaps in the current pension system:

User Stories

We created user stories based on our research to represent a diverse demographic, including people from different backgrounds, cultures, employment types, and life circumstances.

Setting Up Personas

We created 6 personas from the user stories to help the team better understand the needs, behaviours, and goals of users interacting with the state pension system.

User Needs

Based on pain points, I identified what users need from a state pension service.

A clear visibility of how National Insurance (NI) contributions impact their state pension.

Guidance on filling gaps or improve their pension.

Personalised recommendations tailored to their life circumstances.

The ability to track and update their pension forecast over time.

Support tailored to life events (e.g., career breaks, part-time work, or claiming benefits) and how these affect pension outcomes.

A sense of clarity and confidence through accurate and dynamic pension projections.

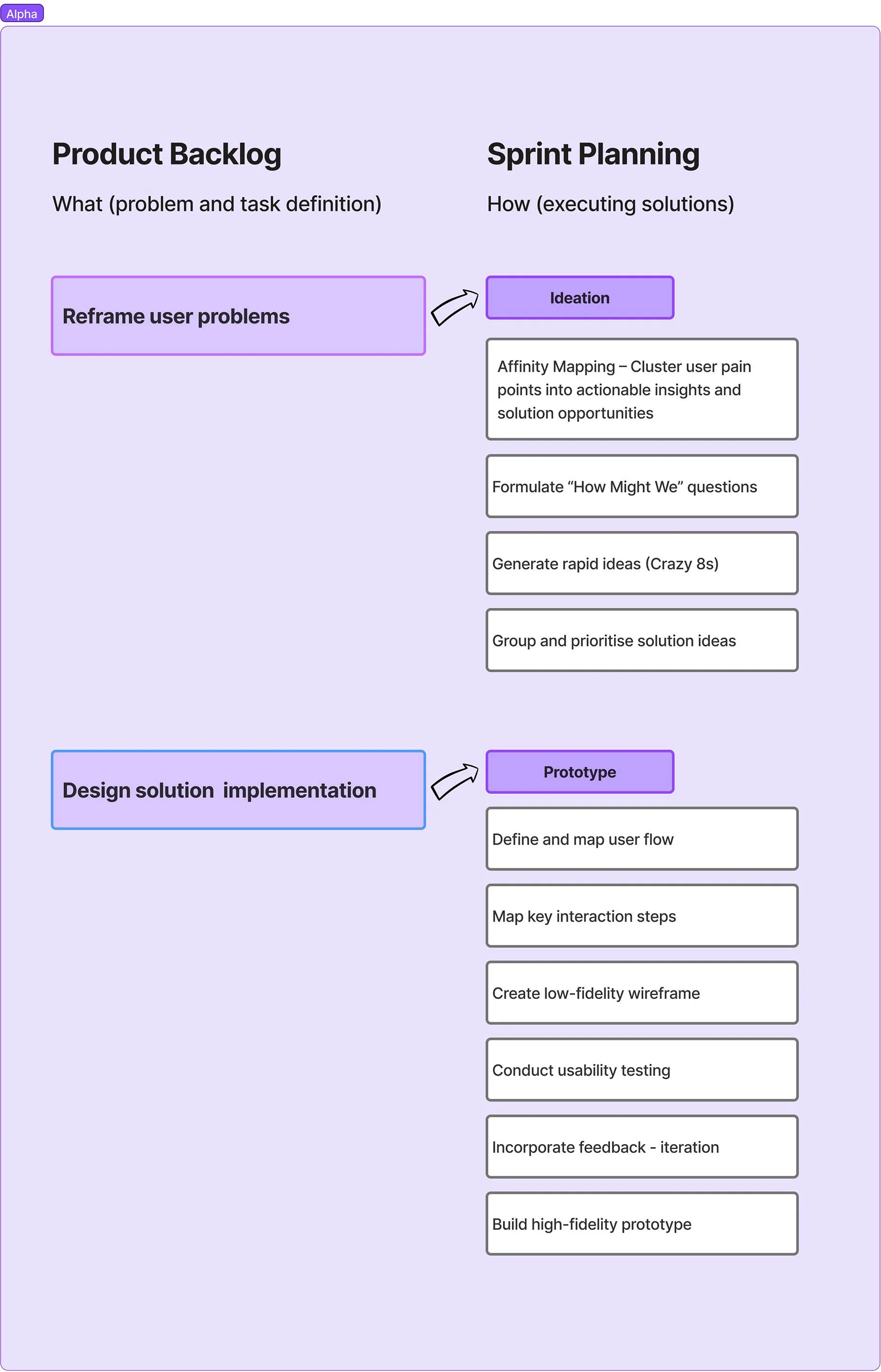

Alpha Stage

Reframing & Ideation

With clear insights from discovery, we reframed core problems into design opportunities and began exploring potential solutions. This helped us define clear design opportunities. We then used creative methods like sketching, Crazy 8s, and user flow mapping to explore ideas. These concepts were developed into wireframes and iteratively refined into a high-fidelity prototype, which was tested and evaluated to validate our solution.

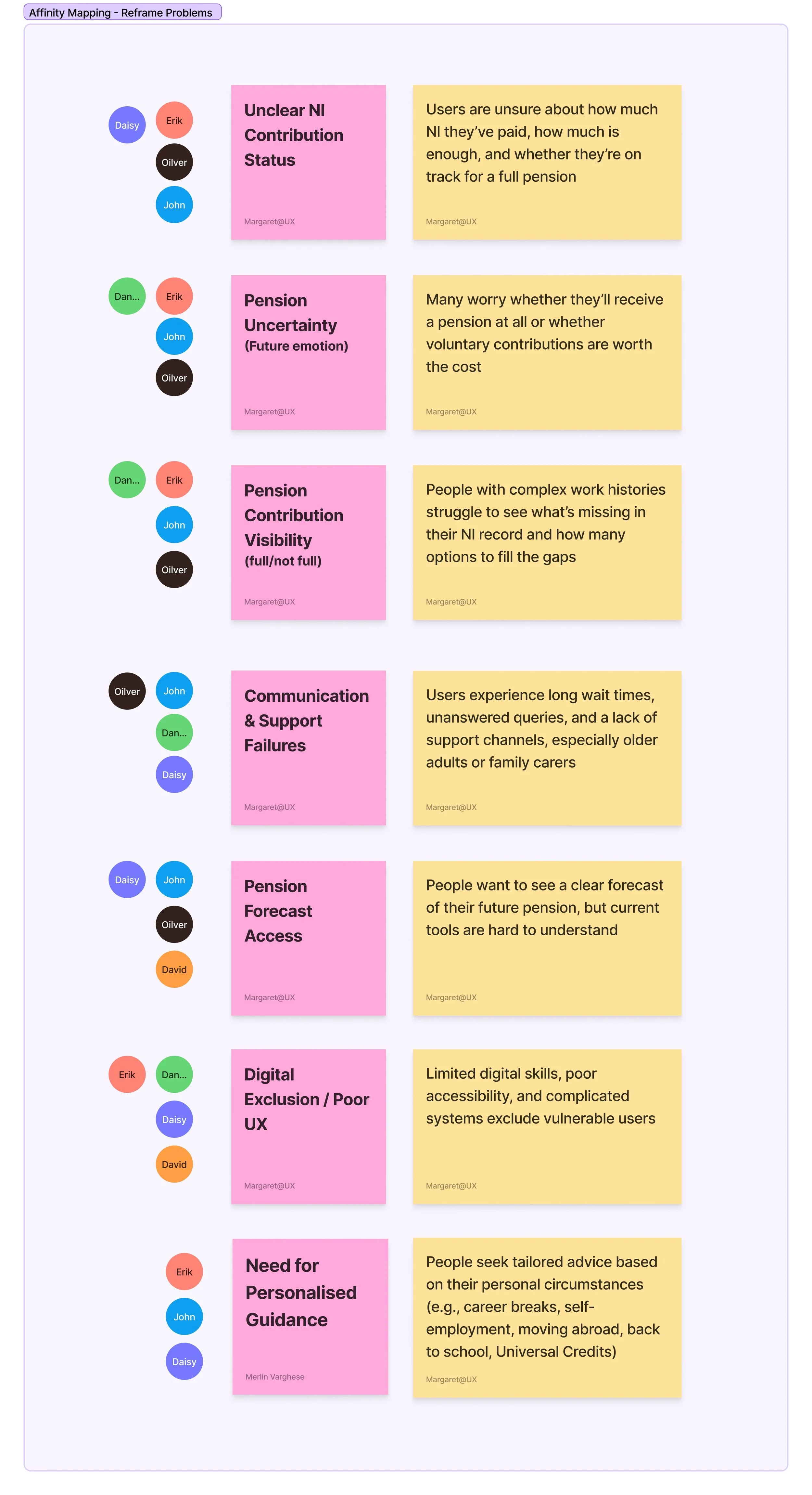

Affinity Mapping

Narrowing down and

cluster user pain points into actionable insights and solution opportunity

We clustered key pain points into actionable insights. This clustering process helped us distill complex feedback into focused insights. These themes reveal critical user frustrations and highlight areas with the most potential for meaningful design solutions.

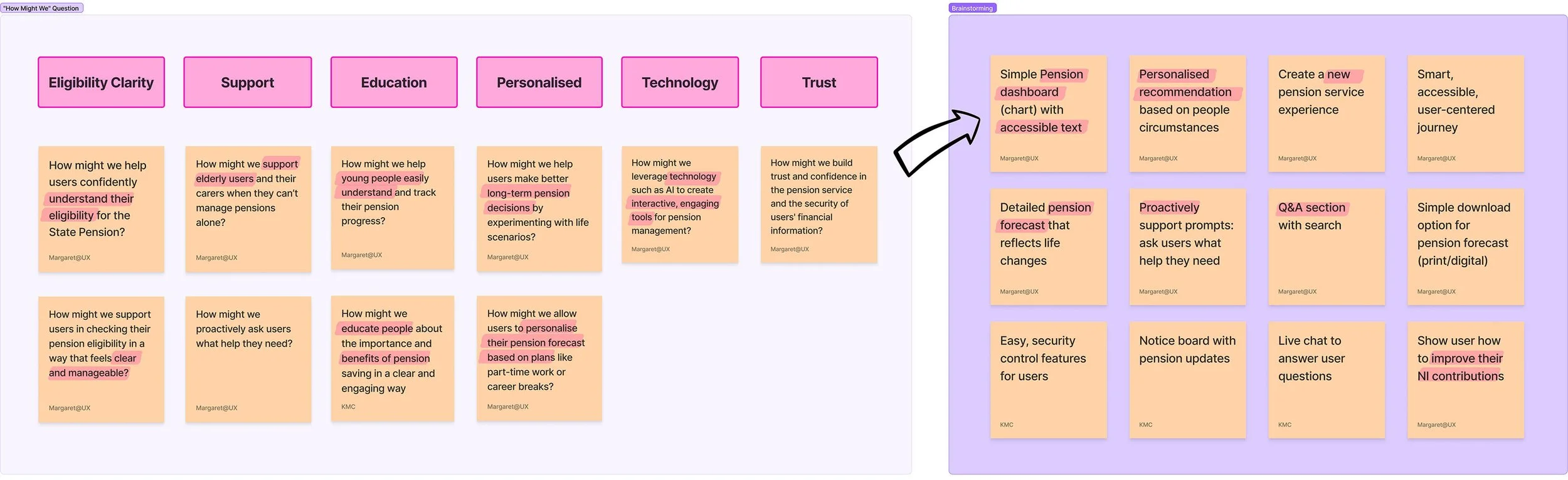

“How Might We” Question & Ideation

To transform user challenges into opportunities, we generated a series of "How Might We" (HMW) questions. Each HMW prompt was grounded in real user needs and helped steer our design thinking toward solution-oriented outcomes.

From there, we entered the the HMW prompts key ideas included:

A pension dashboard with accessible, easy-to-read visualisations

Personalised recommendations based on life events and user situations

A simplified, user-centered service journey to improve usability

Supportive features such as live help, a searchable Q&A section, and downloadable forecast

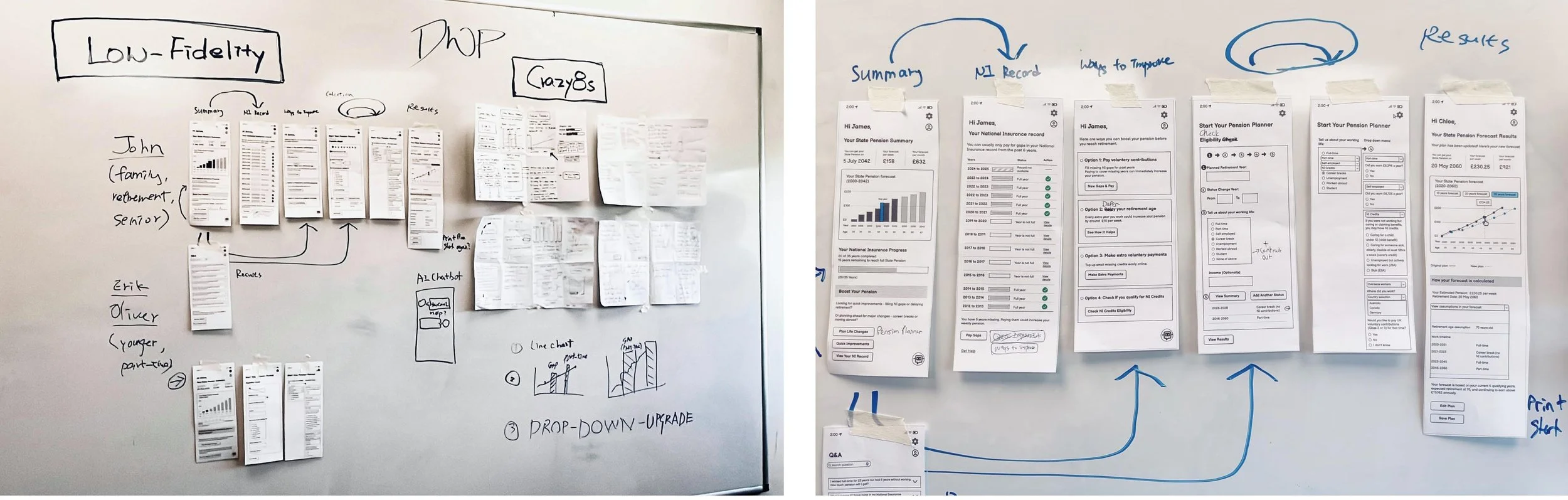

Sketches

Used the Crazy 8s technique to rapidly generate a wide range of UI sketches inspired by our research insights. Each team member produced quick ideas within a short timeframe, helping us explore multiple design directions. After sketching, we clustered and voted on the strongest concepts based on usefulness, feasibility, and alignment with user needs.

Key Ideas That Emerged:

Interactive Pension Forecast Tool

UI enabling users to input work status and life events to generate personalised pension forecasts

Real-time pension timeline

Simple bar graphs to visualise current and projected pension outcomes

NI Gap Highlighter

Interface clearly identifying gaps in National Insurance contributions

Provides guidance on how users can address those gaps — not only by paying missing years but by understanding their available options

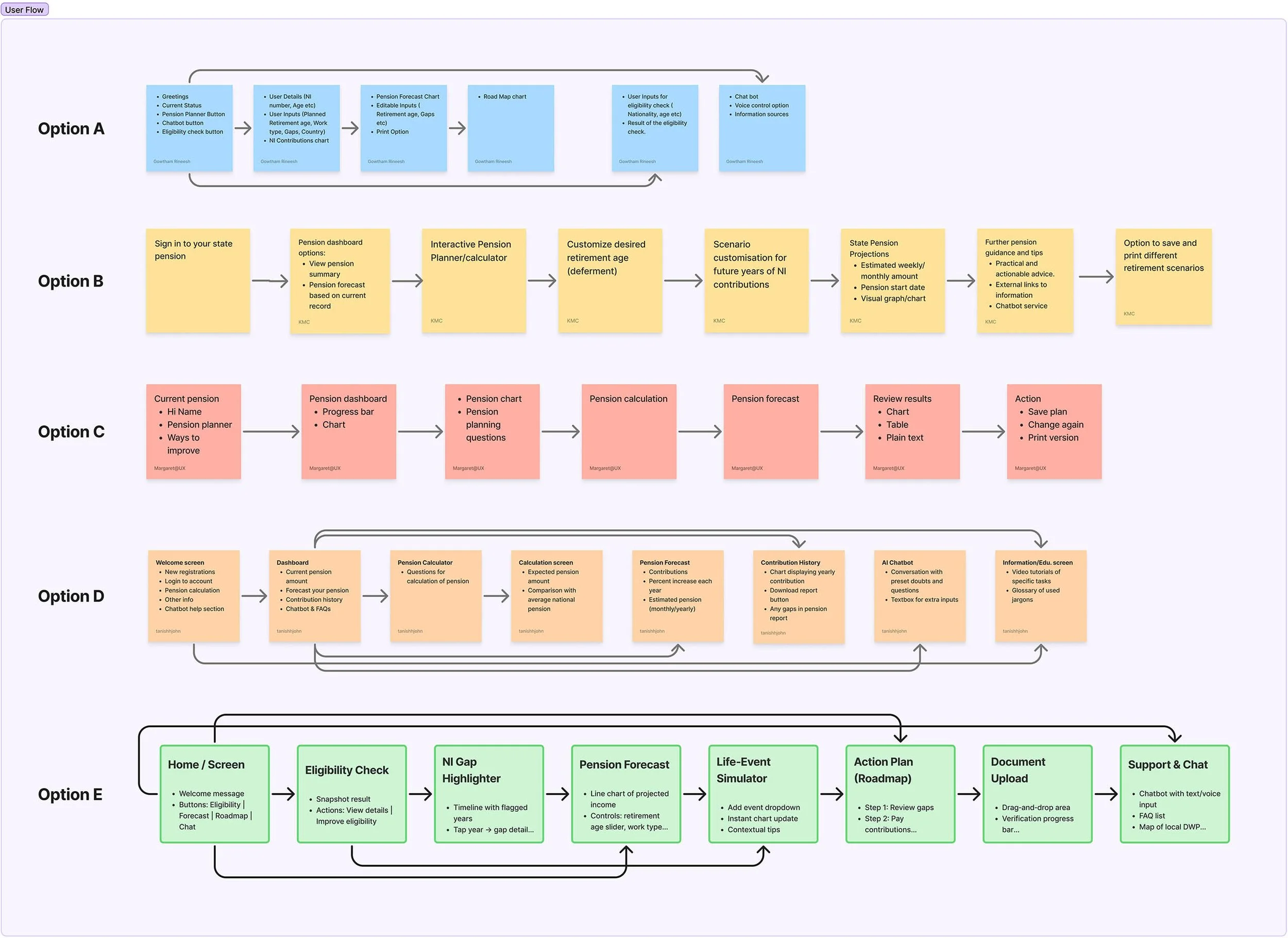

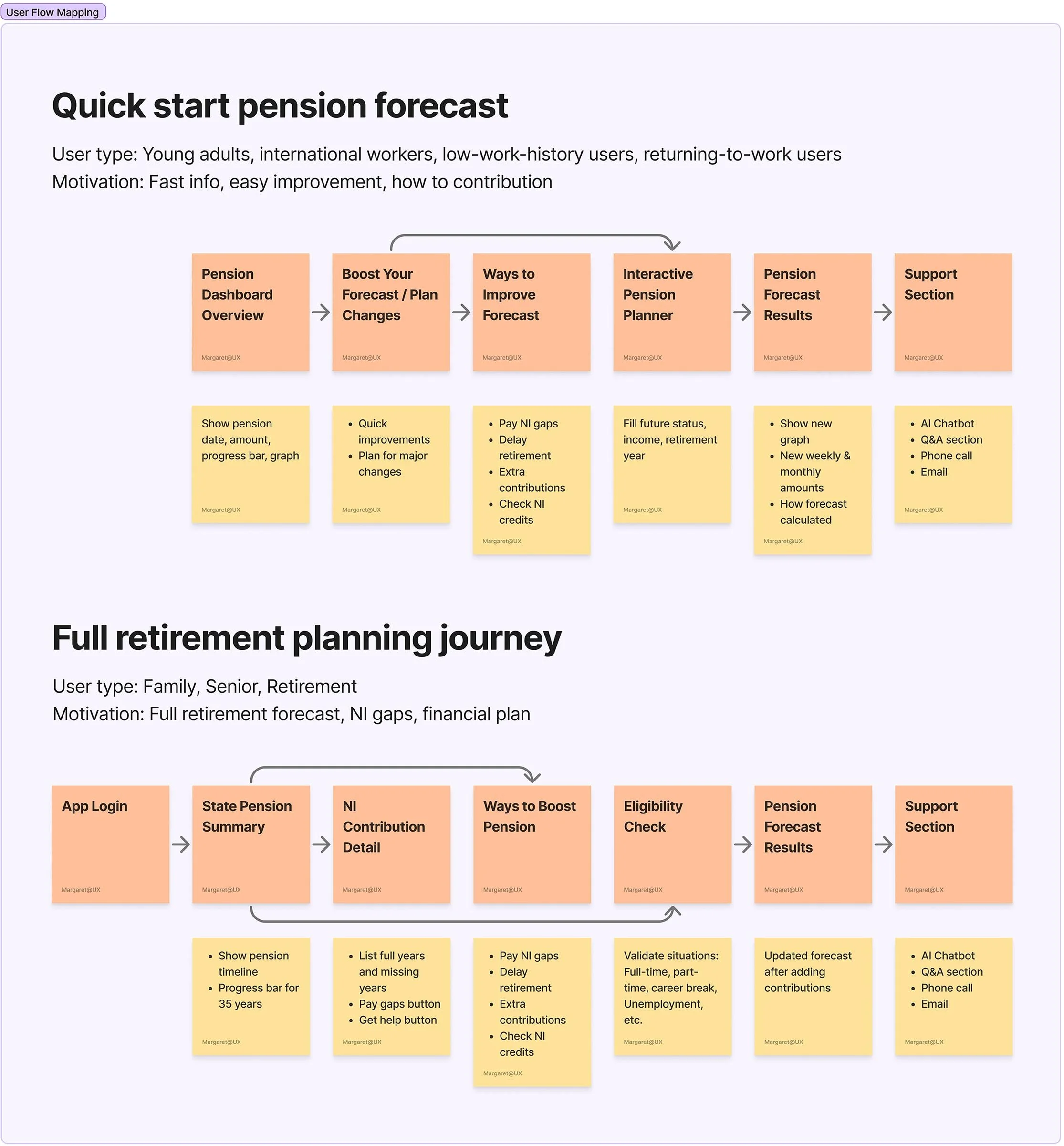

Before starting low-fidelity design, we explored five user flow options and then refined this into two core user journeys:

A quick forecasts journey for younger users who want a fast snapshot

A full planning journey for users who need detailed projections and guidance

Each flow was mapped to include NI status checks, pension forecasts, gap insights, and personalised improvement suggestions.

User Flow & Mapping

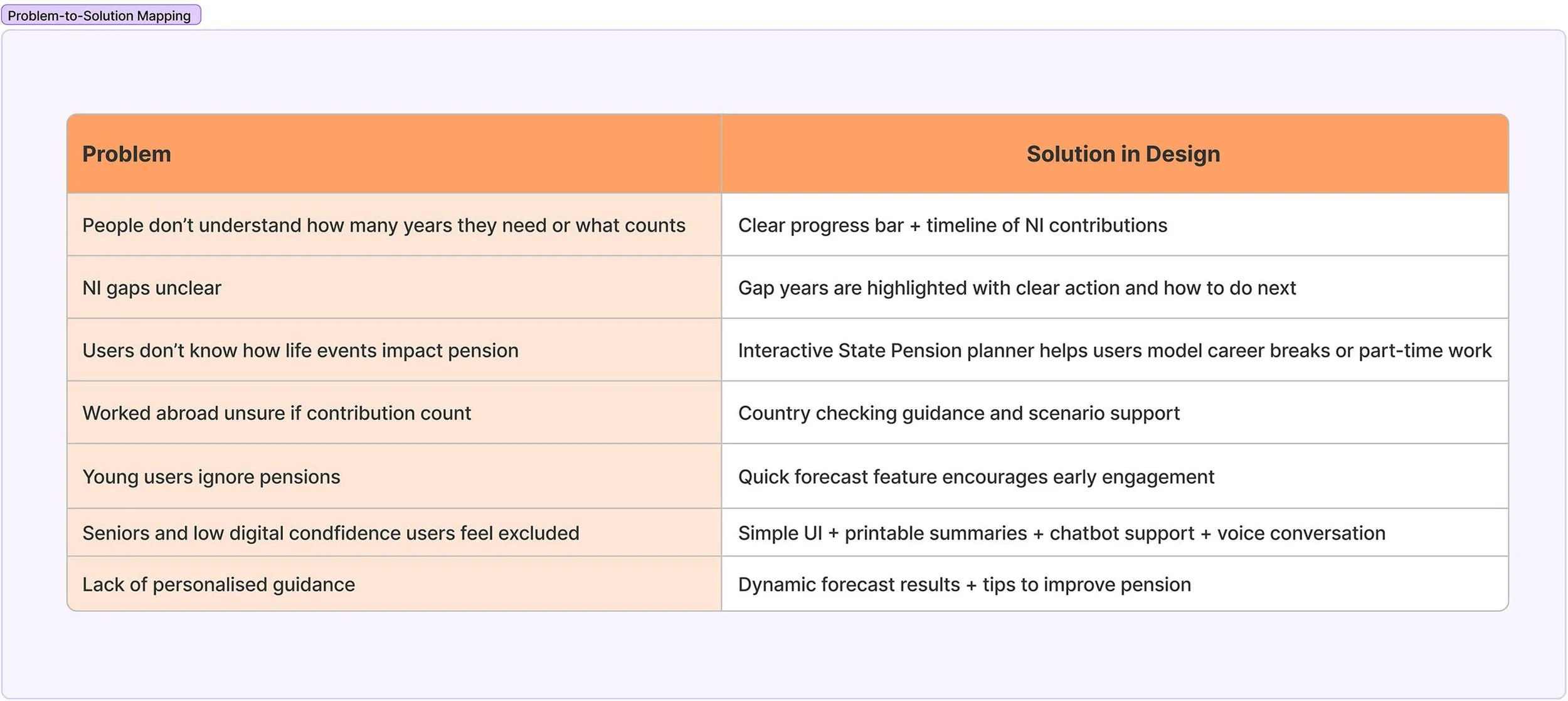

Problem-to-Solution Mapping

To guide design decisions, I mapped specific user problems to UI-level solutions. This helped ensure that every challenge was addressed with purpose and clarity. The mapping also guided me in shaping the interface by connecting user pain points to actionable UI elements.

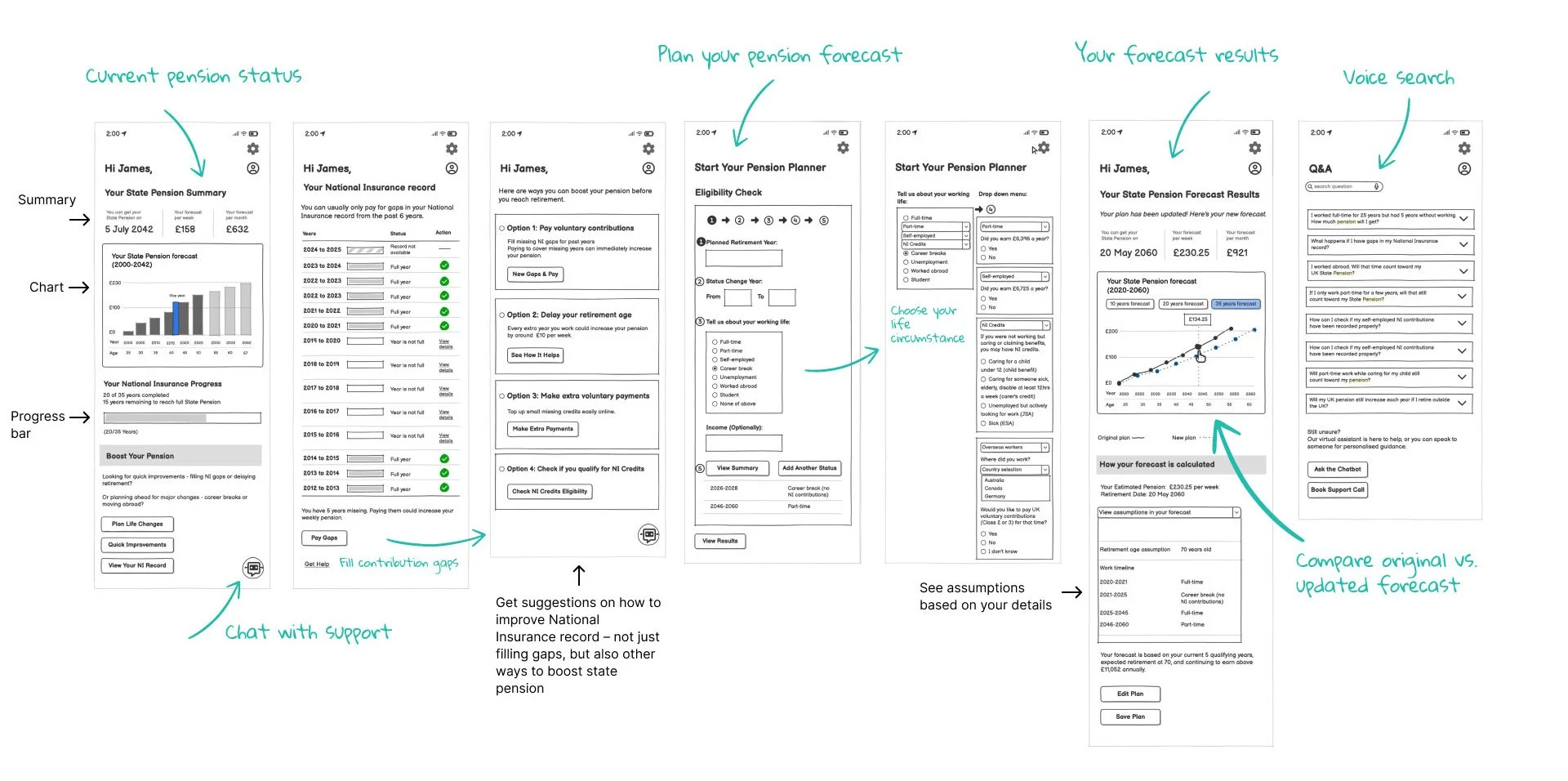

Low-Fidelity Wireframe

I created a low-fidelity prototype, focused on designing a clear, accessible, and supportive journey that enables users to understand their National Insurance (NI) contributions, simulate life events, and explore personalised ways to improve their pension outcomes.

Key screens included an overview dashboard with progress tracking, a detailed NI contribution record, personalised improvement suggestions, a step-by-step pension forecasting tool, and a results screen with visual projections and breakdowns.

In line with UK Government Design Principles, the interface prioritises clarity and usability over decorative visuals, ensuring the service remains inclusive and accessible for vulnerable or low-confidence digital users.

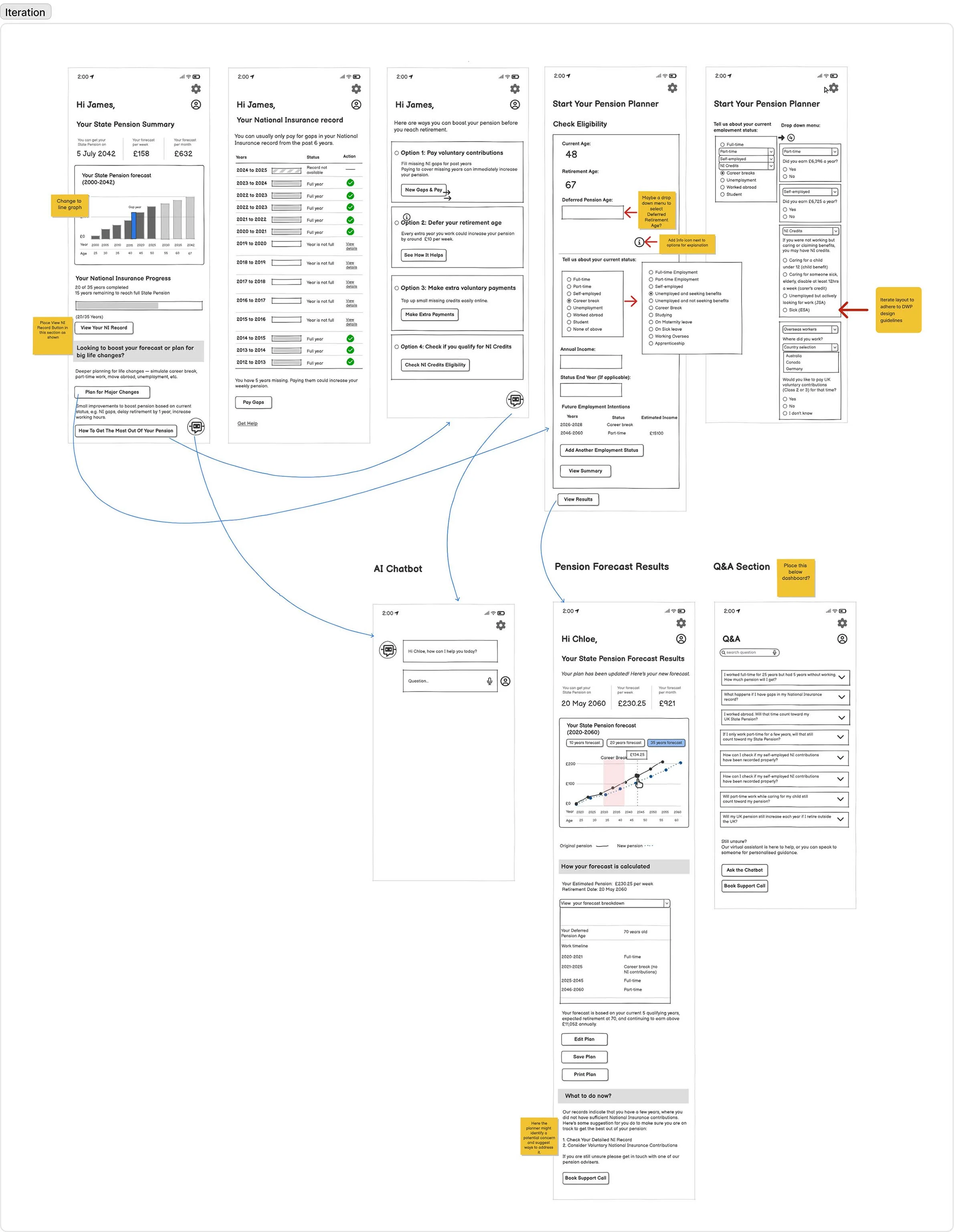

Usability Testing & Design Iteration

After creating the low-fidelity prototype, I facilitated a workshop where team members tested the flow using printed screens.

Iteration Process

Since this was a new service design, the testing focused on how users understood the overall flow, navigation, and use of pension forecasting tools. We aimed to see whether the new design helped users better understand their pensions compared to the existing government app.

Based on feedback, we identified several key improvements for the next high-fidelity prototype:

Replacing the bar chart with a more intuitive line graph for forecast trends

Renaming buttons to be clearer and more concise

Refining wording to align with UK Government terminology — for example, specifying types of National Insurance credits

High-Fidelity Prototype

After completing the low-fidelity wireframes and applying feedback from usability testing, we moved into building the high-fidelity prototype. One of my teammates led the development of the interactive components. All components followed GOV.UK accessibility and layout standards.

The final screens focused on pension overview dashboard, NI contribution record, personalised improvement options, a step-by-step forecasting tool, final results with visual projections.

What I learned from this project

This project taught me the importance of a structured design process, clear team communication, and critical thinking in collaborative UX work. While AI tools were helped with research, I saw that teammates who relied too heavily on automation can limited their depth and empathy required in user-centered design. Human insights still drives good design decisions.

I also learned the value of being detail-oriented and staying motivated and passionate throughout the process to keep team good inspirit. To support team alignment, we used FigJam to collaborate, plan, and document ideas each week. We also weekly catch-ups with the DWP team to review our work and feedback. These sessions helped us stay focused on client expectations and user needs.

Finally, we received positive feedback from the DWP Interaction Design team for clearly defining user problems and identifying a meaningful service gap. They appreciated our user-centred approach in creating a new digital service for people navigating state pension system - an experience that has greatly strengthened my confidence and motivation as a UX designer.

Future Challenges of AI

As AI becomes increasingly embedded in daily life, humans will interact with Conversational AI more naturally. I forecast that Conversational AI will become common within the next few years, and users will gradually adapt to AI as a trusted assistant for public service.

Project.

Healthcare Tech | B2B & B2C | Online Consultations | E-commerce

End-to-End Design Process | Inclusive Design | Healthcare

FinTech | ESG | Digital Reporting | Survey Data Visualisation

Discovery & Alpha | Digital Product | GDS Compliant | GOV DWP

Responsive Design | B2B Insurance | Information Architecture

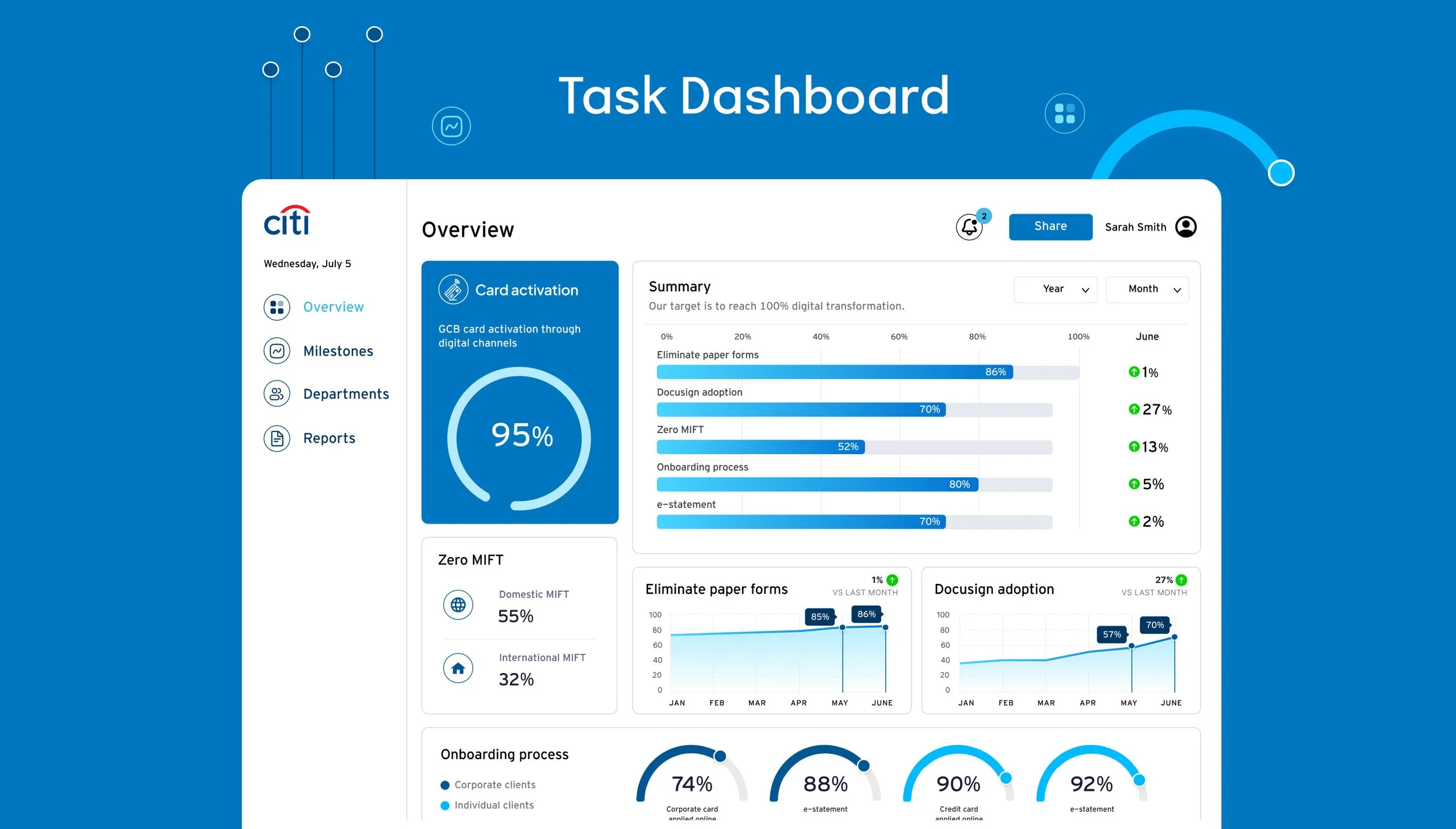

Dashboard Design | Data Visualisation | Widgets | KPI Tracking